We continue our exploration of how financial advisors are managing their own stress during this market crisis with a deep dive into the Financial Planning Association report “The War on Stress 2019.”

In the comprehensive study “The War on Stress 2019,” the Financial Planning Association (FPA) examined how stress affects financial advisors and investors and put the results side by side.1 The report explored core areas such as goal achievement and work/life balance.

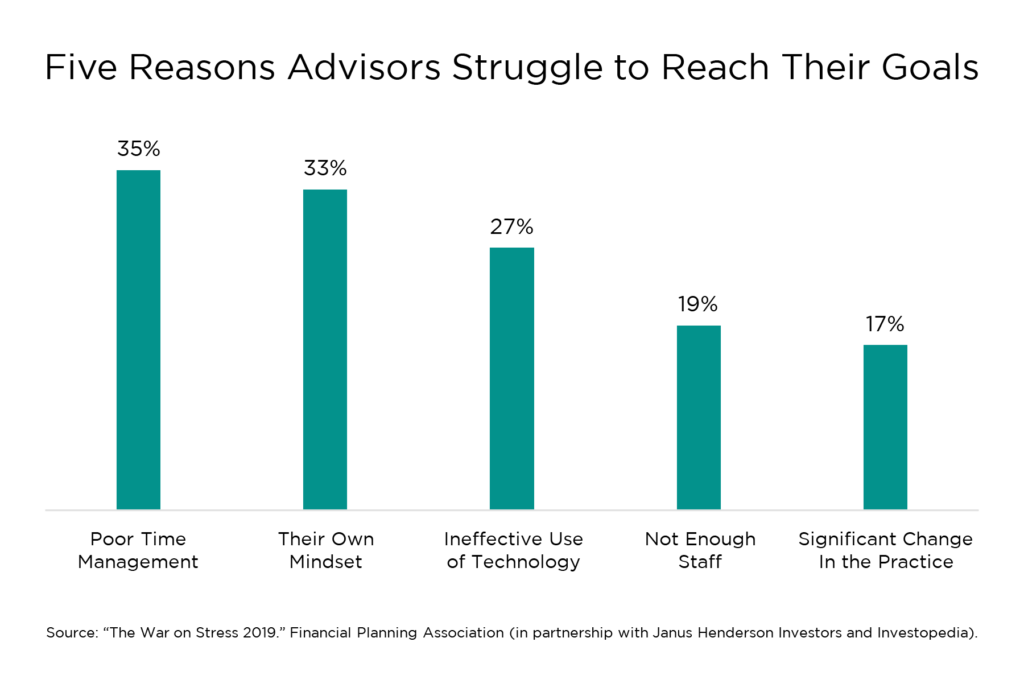

Stress plays a major role in the success or failure of our goals — from inception through to the likelihood of accomplishing them. When asked to consider what was holding them back, advisors identified poor time management (35%), their own mindset (33%), ineffective use of technology (27%), not enough staff (19%) and change in the practice (17%). Advisors who set clear goals and reported lower stress levels “were much more likely to have achieved or exceeded those goals.”2

Stress plays a major role in the success or failure of our goals — from inception through to the likelihood of accomplishing them. When asked to consider what was holding them back, advisors identified poor time management (35%), their own mindset (33%), ineffective use of technology (27%), not enough staff (19%) and change in the practice (17%). Advisors who set clear goals and reported lower stress levels “were much more likely to have achieved or exceeded those goals.”2

The study clarified that stress really falls into two categories: positive stress and negative stress. Positive stress is generally viewed as a motivator, such as when nerves boost your adrenaline right before making a speech in front of a large audience. Negative stress doesn’t provide any of the same benefits, but it can adversely affect your health and productivity. Think “good fat” and “bad fat” as a comparison.

Side by Side Results: Financial Advisors and Investors

The following responses offer an interesting view into the similarities between advisors and investors. For advisors, finding common ground with their clients on topics whether positive or negative can be useful in strengthening client relationships. In the areas noted below, advisors and investors had parallel views of how stress shapes their world.

Less Negative Stress Likely to Have a Positive Effect

- 60% of investors and 84% of financial advisors strongly agreed that there would be a positive impact on business life.

- 75% of investors and 85% of financial advisors expected less negative stress would enrich their personal life.

These results indicate that advisors recognize they are experiencing elevated levels of stress. Advisors often remind their clients that discipline is required to stay the course to achieve their financial goals, but it is easy to forget that stress management demands the same vigilance.

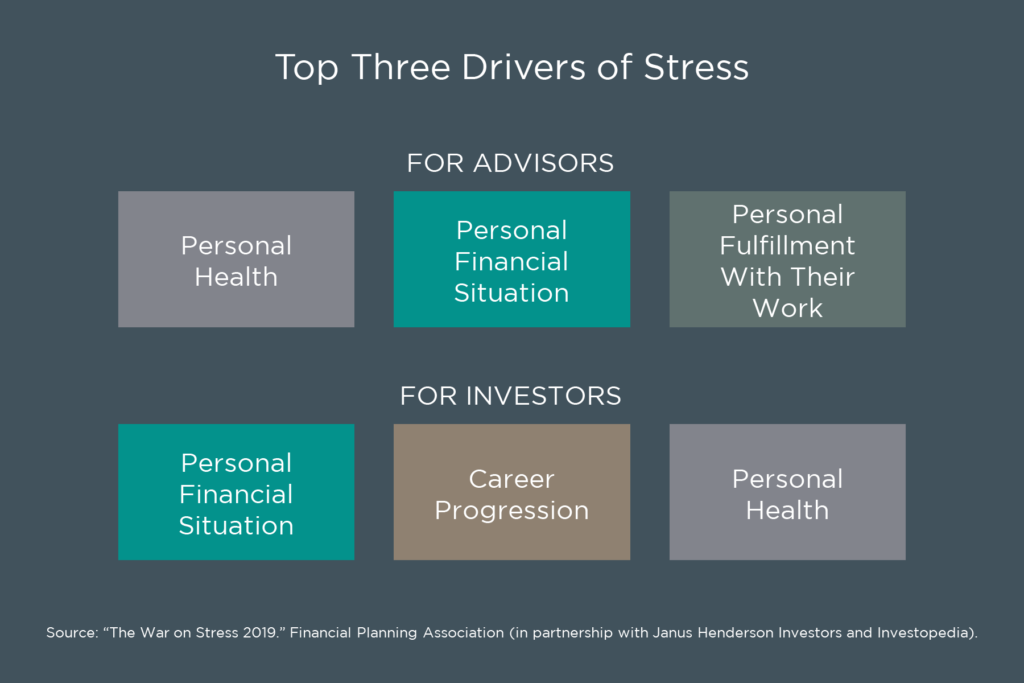

Three Top Drivers of Negative Stress

By looking at levels of personal satisfaction over several categories, the report pinpointed “those factors that had the highest correlation with stress.”3

Investors and financial advisors surveyed had nearly the same concerns in several personal areas, which were manifesting into causes of additional stress.

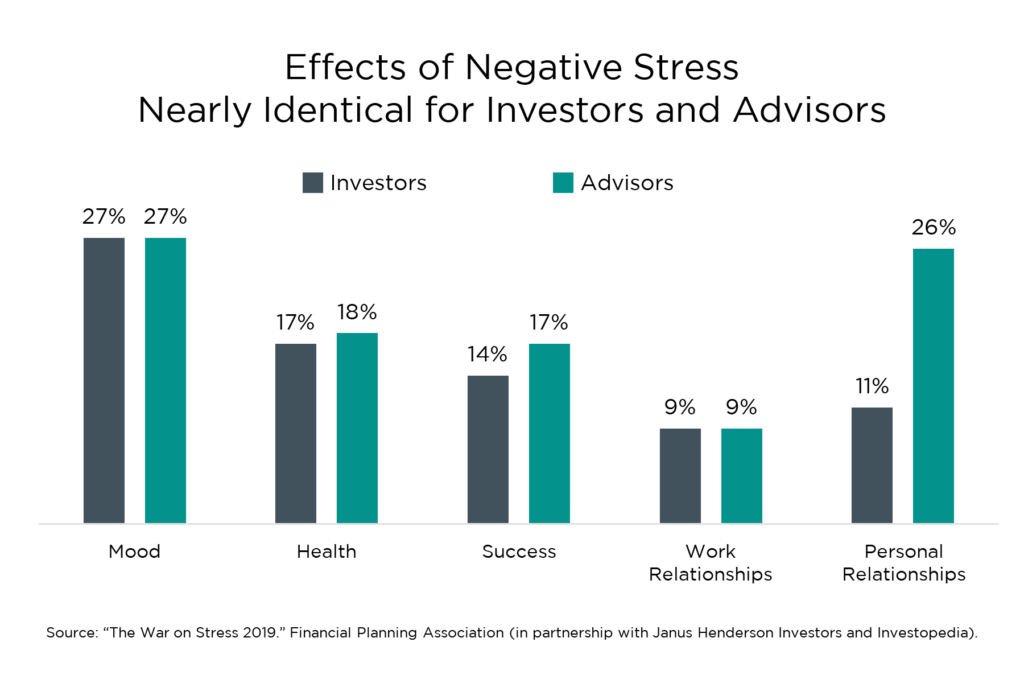

Negative Stress and Personal Life

Responses about how stress has had a significant impact on personal areas of life were nearly identical for investors and financial advisors in the following areas: mood, health, success and work relationships. It is worth noting that one area for advisors that registered a substantial spike was in personal relationships (11% to 26%).

You Can Change How Much Negative Stress You Experience

You Can Change How Much Negative Stress You Experience

Some advisors may be unsure of how to reduce stress but remain open to taking steps to change their habits. However, advisors who assume it is just part of being a financial advisor may not realize this mindset can be detrimental to achieving success over the long term. For the latter group of advisors, it is critical to find ways to reduce stress that will be long term instead of quick fixes that are not sustainable.

The one showstopper for overextended advisors is not having their own team of professionals to support them through difficult times. Without this network, advisors risk allowing stress to wear on them and stop them from being productive in their role as a financial advisor. A team can take many forms, including mentors, colleagues, team members and strategic partners.

These actions can help you reduce negative work-related stress:

- Make small changes that are easy to incorporate into your daily work routine.

- Regularly connect with individuals in your network, whether you are seeking support or helping a colleague.

- Acknowledge when you notice positive changes in your behaviors and improvements to your work routine.

- Stay connected to your network, which will energize you as you provide support and comfort to your clients.

Whatever you do to reduce your stress levels, give yourself enough time for any new routines to become habits. The benefits are absolutely worth the effort.

What’s Your Stress Level?

To assess your current level of stress, take the “War on Stress” self-assessment, found in the original 2019 report. By answering 20 questions, you can quickly find out if you are slightly stressed or seriously stressed according to the Janus Henderson Knowledge LabsTM evaluation.

We help advisors establish and grow successful wealth management practices. To learn more about how we can help you amplify your life’s work, contact us at team@waalliance.com. You can follow us on Twitter@theWAAlliance and on LinkedIn.

Sources

1 “The War on Stress 2019.” Financial Planning Association (in partnership with Janus Henderson Investors and Investopedia).

2 Ibid.

3 Ibid.

By clicking on a third-party link, you will leave the Wealth Advisor Alliance website. We are linking to this third-party site to share information in a different format and is for informational purposes only. However, we cannot attest to the accuracy of information provided by this site or any other linked site and do not endorse the site sponsors or the information or products presented there. Privacy and security policies may differ.